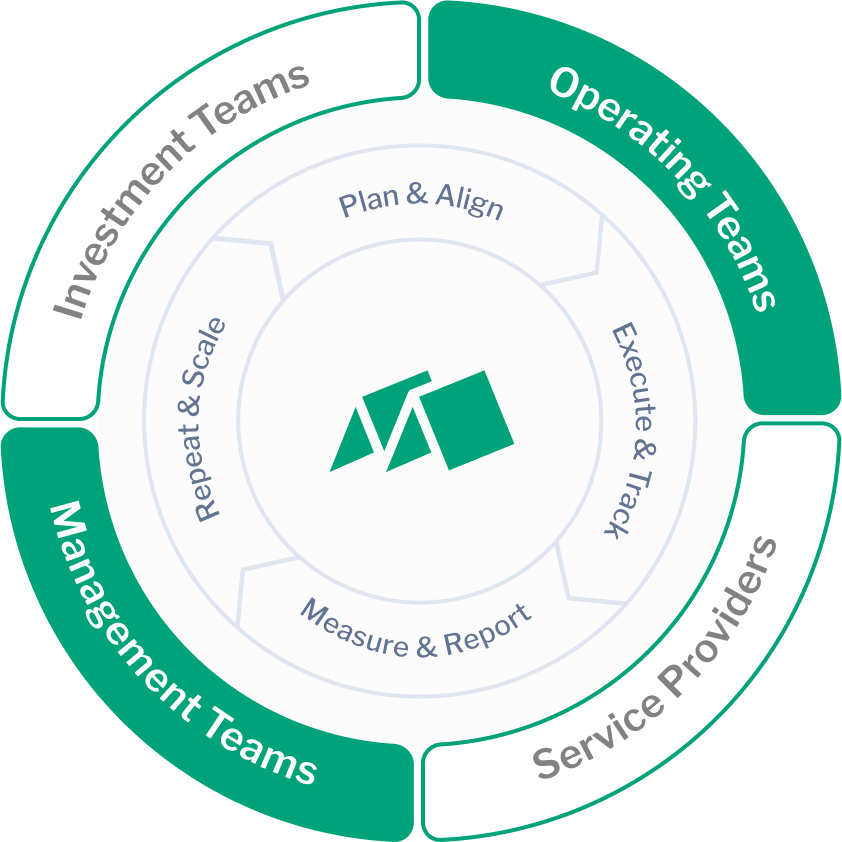

Manage the PE investment lifecycle

Maestro maximizes returns for all stakeholders by elevating financial and operational performance, enhancing collaboration and alignment, and accelerating value creation.

MEET MAESTRO

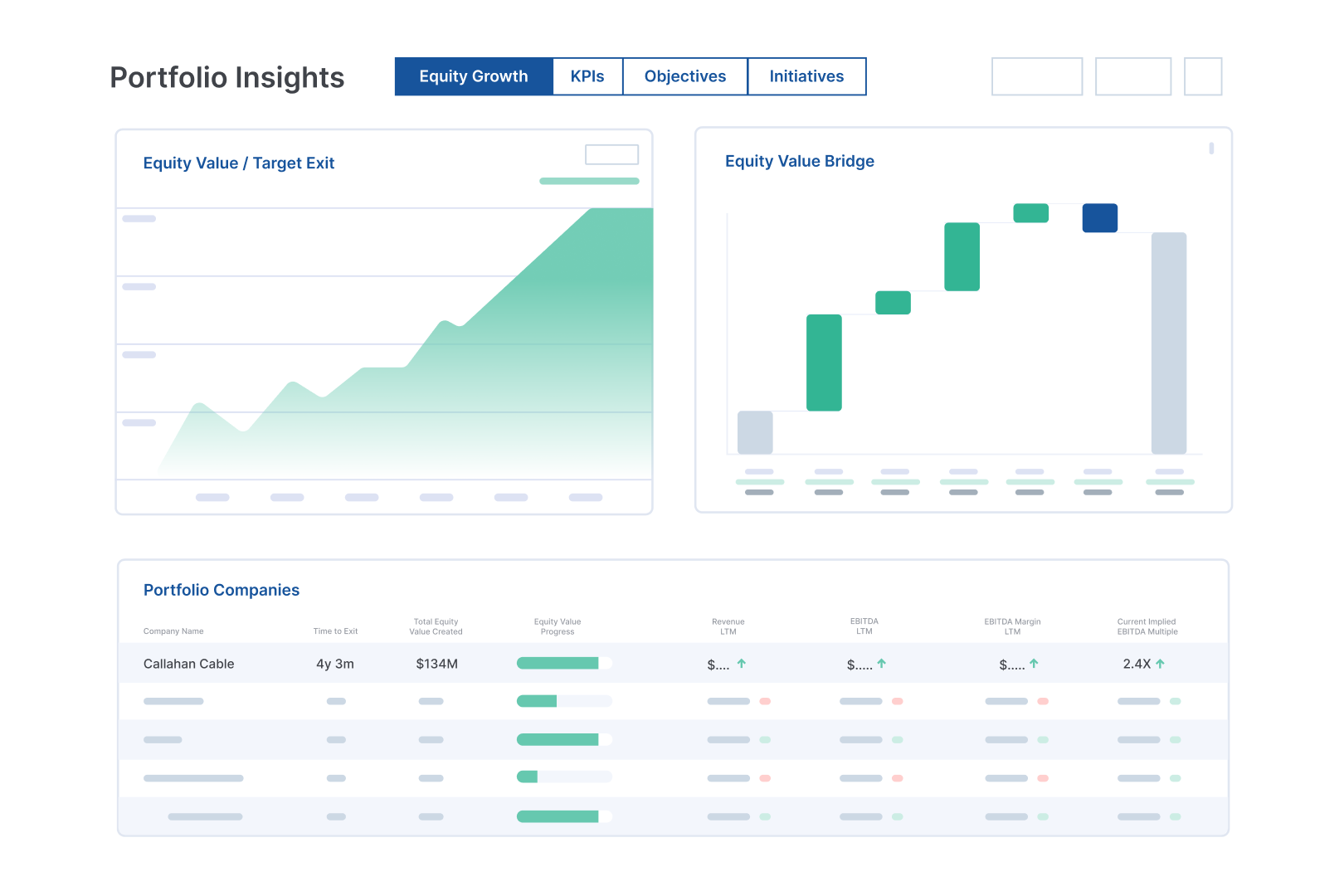

Accelerate Value Across Your Portfolio

From planning to exit, Maestro provides PE teams with a centralized solution for tracking value creation initiatives, managing portfolio growth, and strengthening alignment and collaboration among all stakeholders.

From due diligence to value creation to exit planning: Maestro is purpose-built by PE industry professionals to streamline all these processes – and more.

Due Diligence

Every PE deal requires a lengthy and laborious due diligence process. Not for long. With Maestro, you can institutionalize your entire due diligence workflow, making it smoother, consistent, and repeatable, ultimately enabling more timely, informed decisions on each deal.

Maestro also eliminates the headaches of version control by providing a collaborative workspace to track status, update priorities, assign tasks, reference comments, and more.

Value Creation

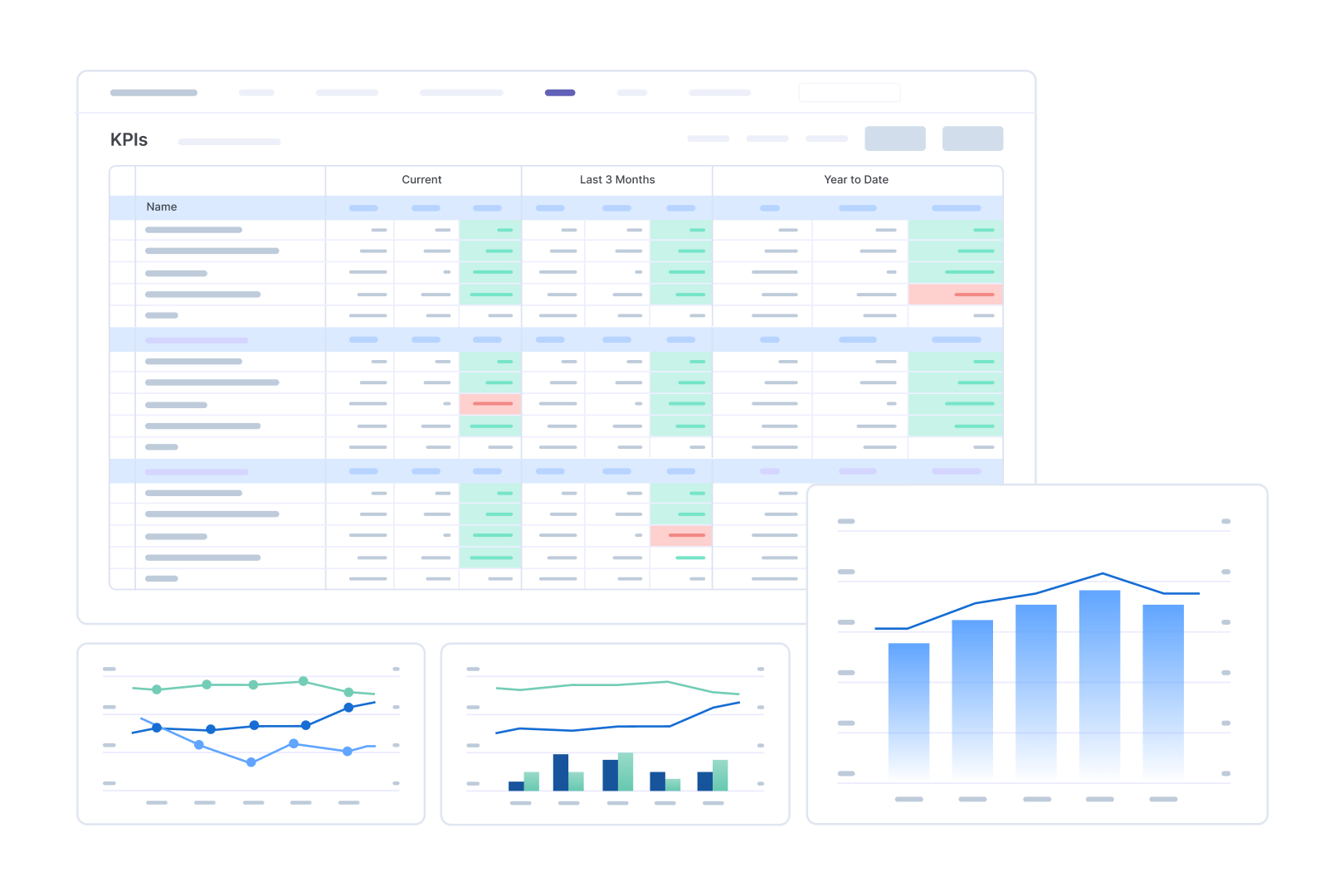

LPs today expect fund sponsors to have a professionalized and structured approach to operational value creation. With Maestro, you can capture and codify firm-wide knowledge and establish a centralized, repeatable framework for value creation planning, management, and execution.

Access and activate our exclusive library of playbooks to identify new opportunities, sanity-check your existing plans, and transform them into an actionable plan for your management team.

Exit Planning

Maestro empowers an efficient and attractive exit, alleviating the pressures of exit planning by highlighting outstanding value creation opportunities to the next buyer. Instead of relying on dispersed data and itemized initiatives, Maestro will help you tell the company’s past and future growth story.

Maestro’s Objectives enable seamless reporting of strategic priorities in relation to KPIs while Knowledge Hub provides an easy way to impress prospective buyers by showcasing untapped investment theses and actionable plans.

Powering More Than

Portfolio Companies

Private Equity Sponsors

Value Creation Initiatives

See the Difference

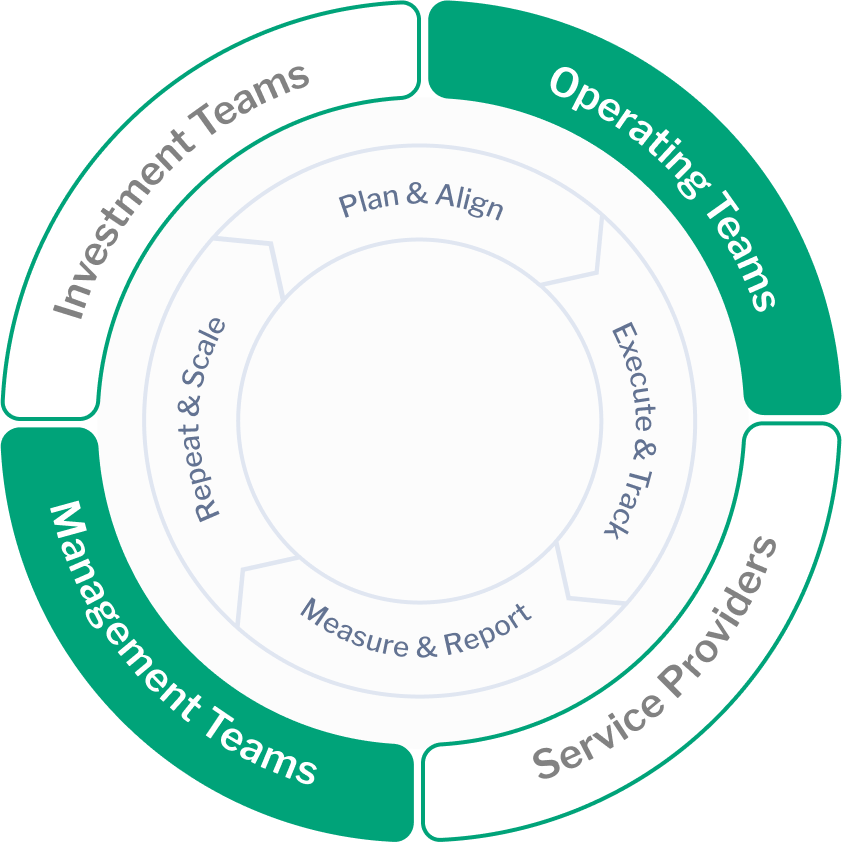

Plan & Align

Inconsistent value creation planning and absence of true alignment and collaboration between sponsor and management teams

Strategy

Enhanced alignment and clarity among all teams around strategy, tactics, ownership, and success measures

Execute & Track

Lack of ownership and understanding of desired outcomes among team members with limited ability to gauge status of projects

Value

Track progress of strategic initiatives seamlessly, leading to increased accountability and flawless execution of the value creation plan

Measure & Report

Data manually inputted into Excel spreadsheets, reports and documents shared via email, and presentations recreated for each meeting

Efficiency

Automated data flows powers a single source of truth on KPIs, saving countless hours spent data wrangling and developing unique content

Repeat & Scale

Lack of transparency and documentation around successful strategies and tactics, leading to minimal sharing of best practices

Success

Value creation success stories are captured in a structured manner, enabling repeatability across the portfolio

Hear From Clients Directly

Argonaut approaches each of its investments as a partnership with the seller, and immediately recognized Maestro’s strengths in helping its portfolio partners grow their companies’ top and bottom lines. Within weeks of launch, the Argonaut operations team had Maestro up and running, using it to craft detailed value creation journeys and to track KPIs tied to investment objectives.

Brian GreenVice President, Argonaut Private EquityMaestro has become an invaluable platform used across our organization to seamlessly organize, measure, and track value creation initiatives across the enterprise.

Andrew CisnerosVP of Strategy, Channel Control Merchants, LLCWith value creation at the core of our approach, we had no choice but to make this software package the heart of our technology roadmap –> PE 2.0

Sander van WoerdenFounding Partner, Lexar PartnersSchedule a Product Briefing

Serving the world’s premier private equity firms and their portfolio companies, with offices in New York City and Boston.

Where to Find Us:

New York City

One Vanderbilt Ave, 24th FloorNew York, NY 10017

Boston

100 Franklin StreetBoston, MA 02110

Eager to Learn More?

Download our brochure to learn more about how you can accelerate value creation at your firm