For Emerging managers

Establish efficient operations, source and manage talent, track value creation initiatives as the portfolio grows, and showcase your impact to existing and prospective investors.

A modern, tech-enabled operating model from day 1

In today’s frenzied and hyperactive Private Equity environment, emerging managers who leverage the power of technology can distinguish themselves with LP investors, better compete for deals, and immediately begin driving growth and value across their nascent portfolios. Maestro is the Private Equity technology platform that enables new funds to begin operating and investing with a modern, technology-powered approach from Day 1.

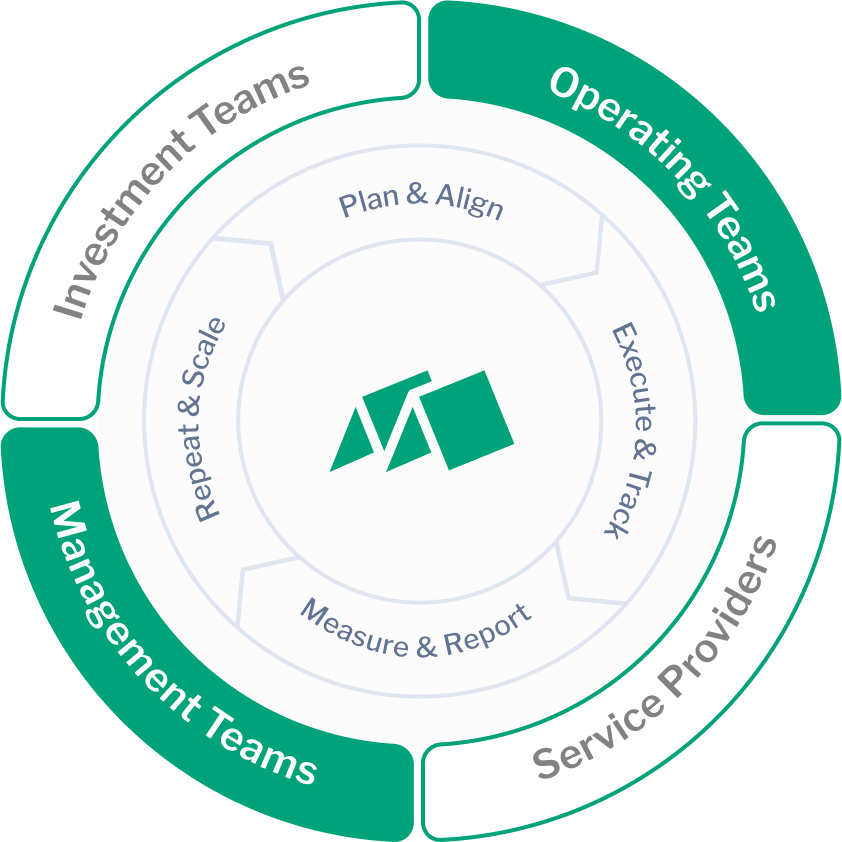

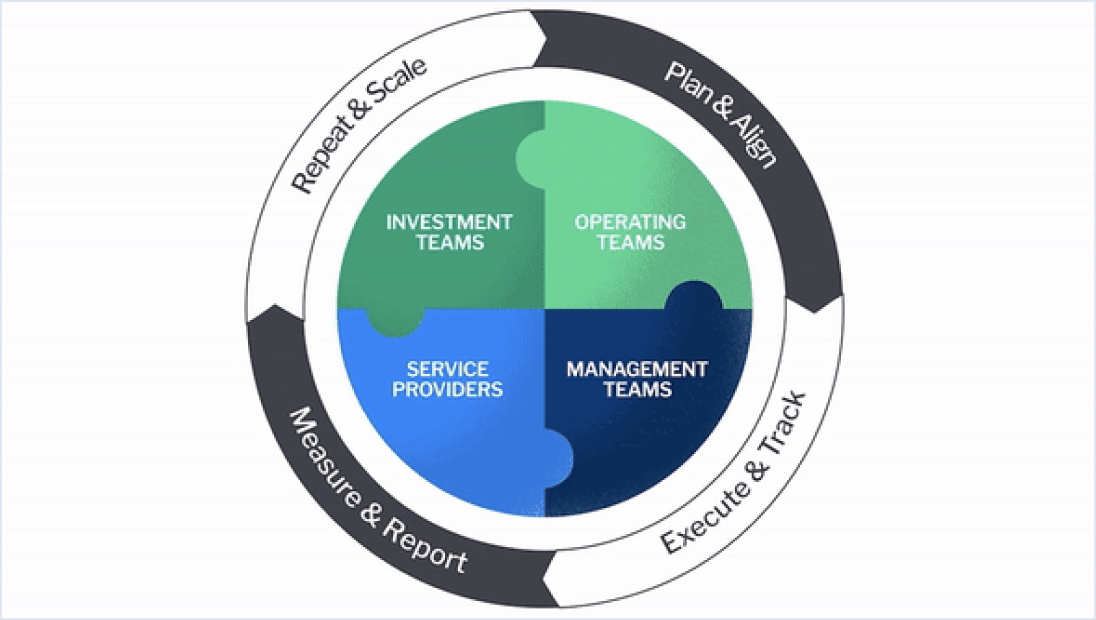

Plan & Align

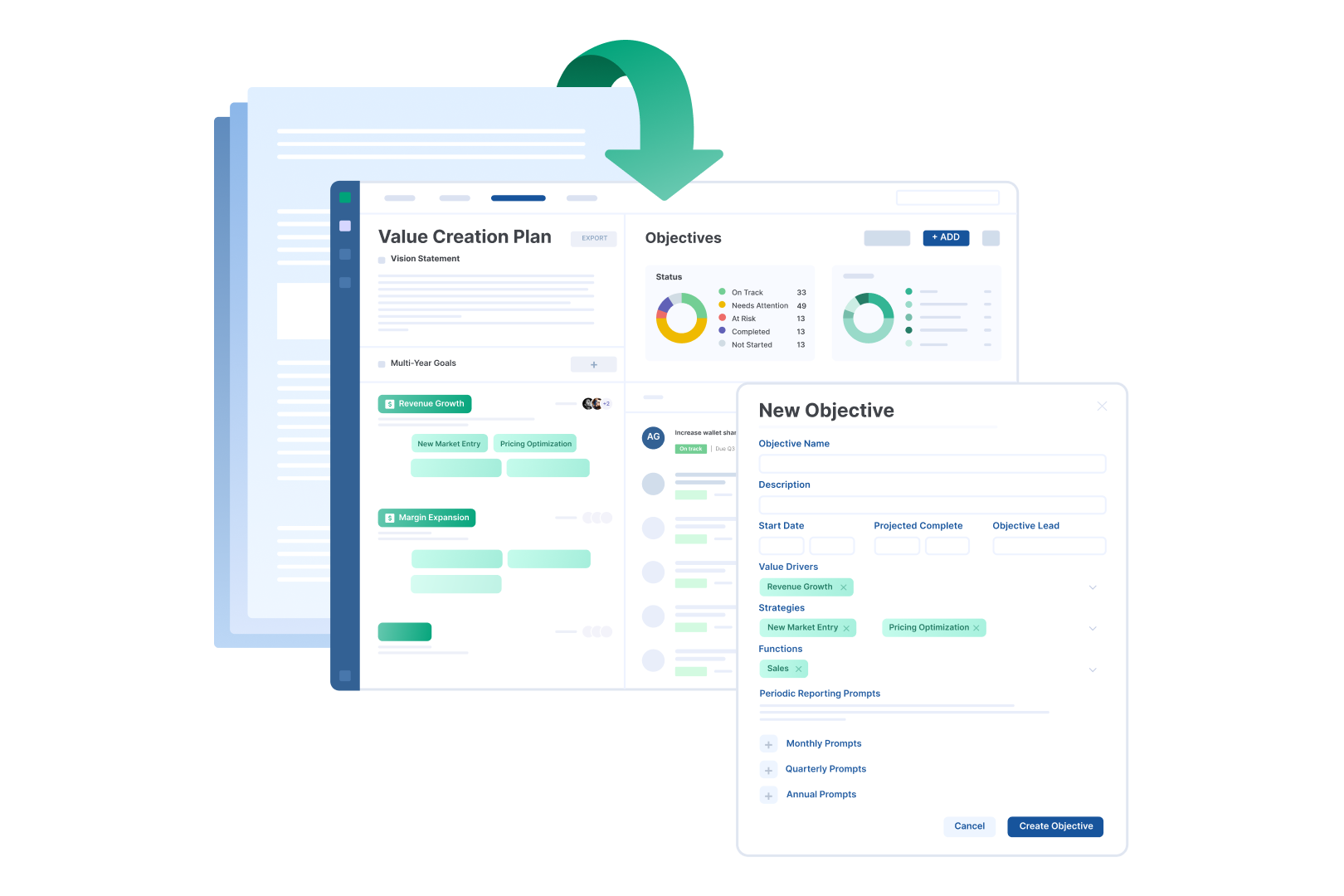

Define Your Strategy, Build Your Plan, Achieve Alignment

Drive alignment, collaboration, and connectivity among deal teams, operating partners, and portfolio management to ensure alignment and understanding of the investment thesis from day one. Establish accountability around and clear ownership of activities and tactics.

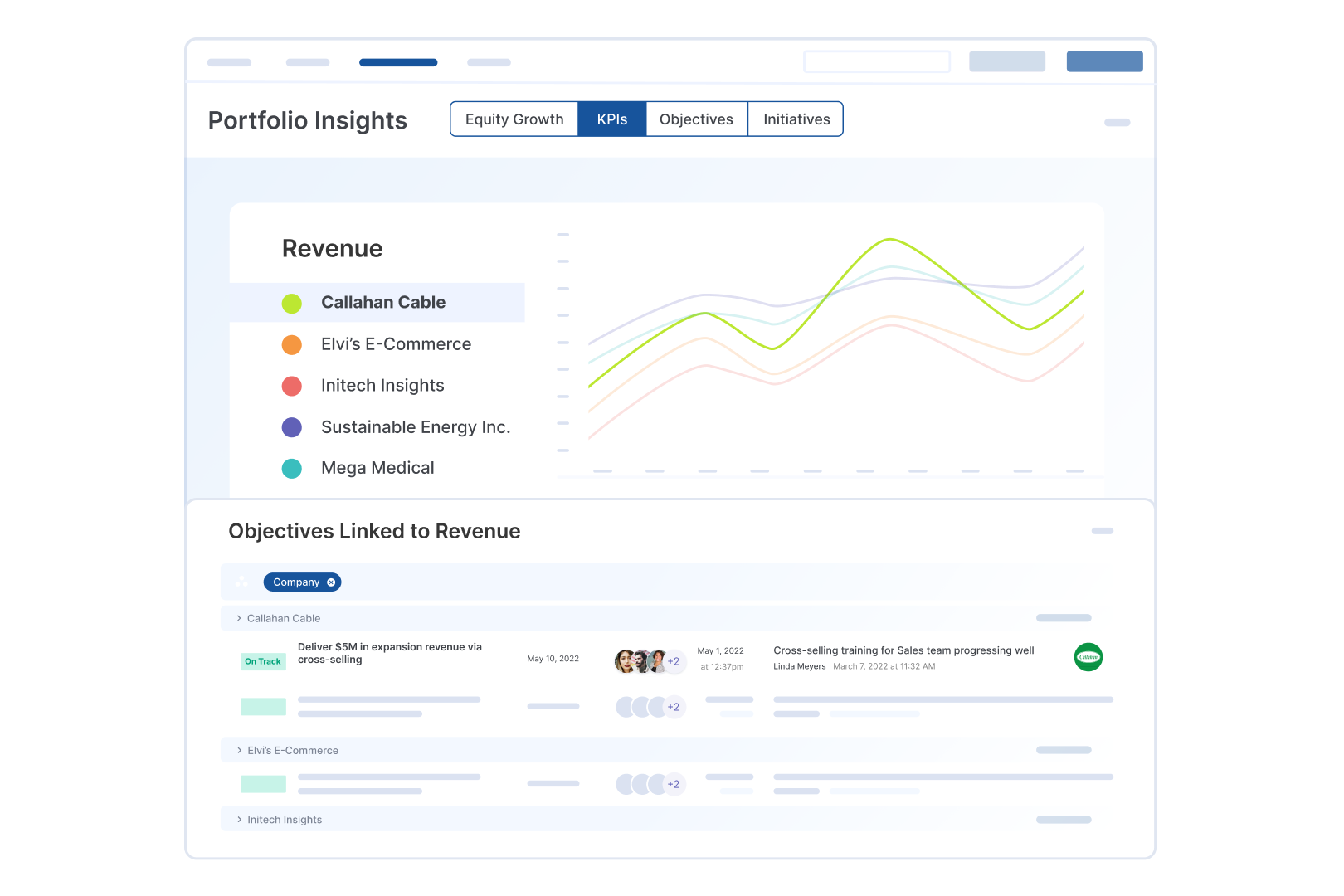

Execute & Track

Activate your Plan, Monitor Real-Time Progress

Deploy the fundamentals of your value creation plan with clarity and purpose. Collaborate fluidly with management teams to implement tactics and approaches while providing deal teams and LPs full visibility and transparency as strategies and activities are executed.

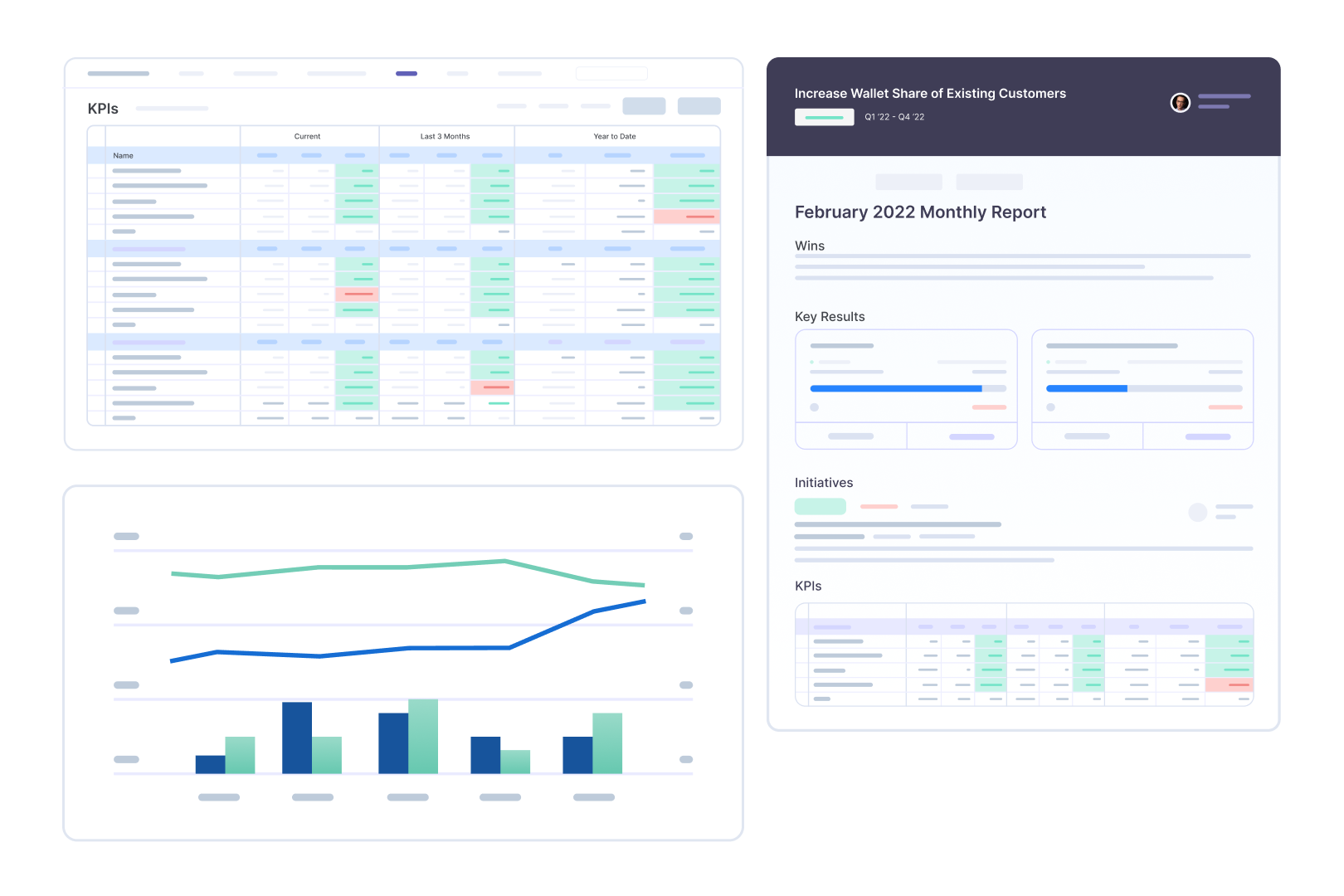

Measure & Report

Gauge your Impact, Showcase Outcomes to Stakeholders

See progress against the value creation plan in real-time. Capture and consolidate key measurement data derived from operating and management team activities. Generate streamlined, templated progress reports for deal teams, investors, and stakeholders.

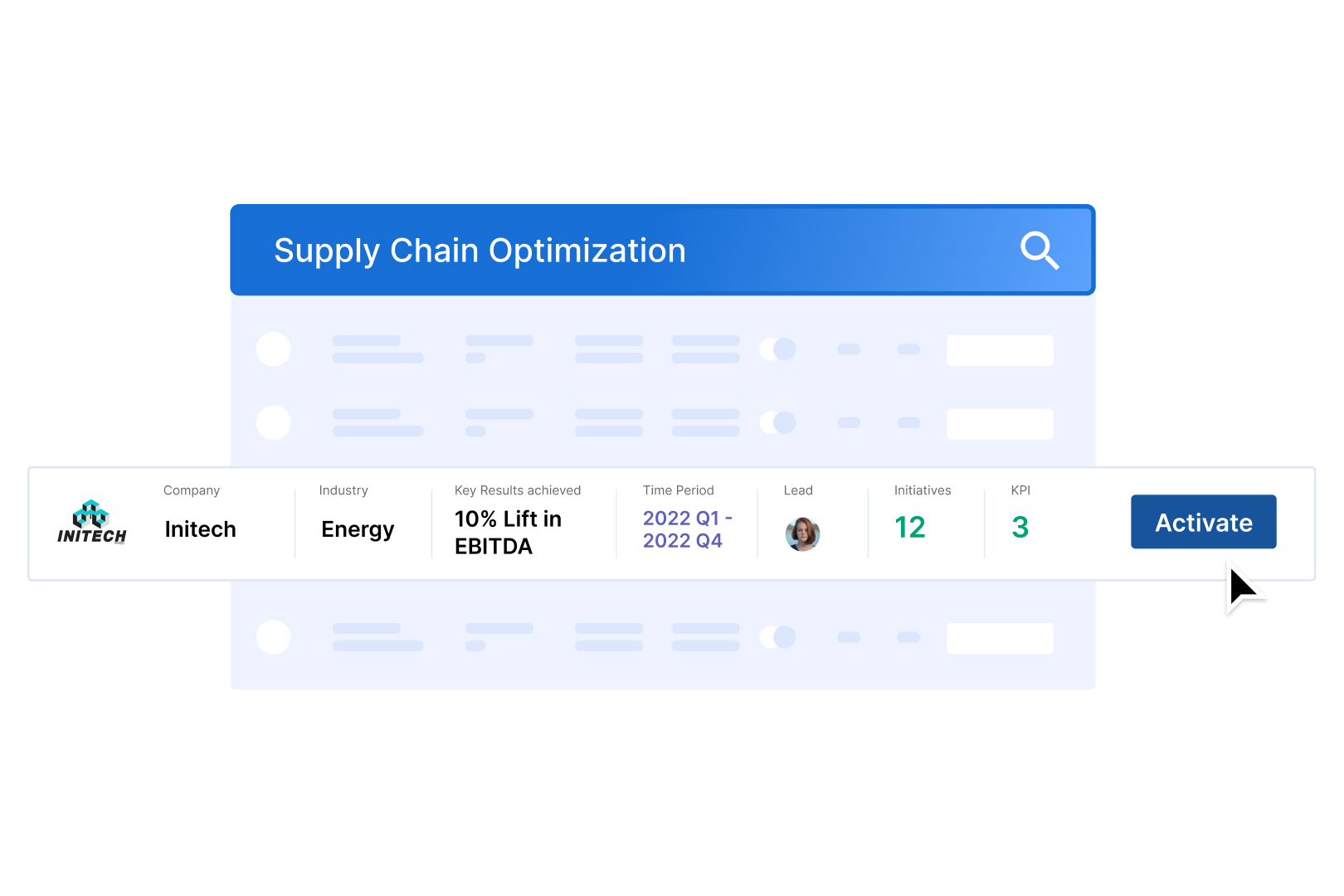

Repeat & Scale

Capture Successes, Institutionalize Winning Plays, Replicate Across the Portfolio

Memorialize successful and repeatable value-creation wins for incorporation by deal and operating partners into future value creation plans. Formalize approaches that worked into playbooks, KPI templates, and other resources accessible to your peers in the Knowledge Hub.

A Single Source of Truth for Value Creation

See How it Works For Portfolio Companies

distinguish your fund

Immediately begin building your track record of success and establish your unique approach to PE operations.

establish best practices

Codify your firm’s best practices and processes governing all phases of the PE lifecycle from the moment your fund is launched, resulting in a repeatable value creation strategy.

win more deals

Illustrate your ability to accelerate value creation through a partnership driven approach with enhanced collaboration and access to smart capital.

achieve operational excellence

Across due diligence, value creation tracking, and exit planning activities, execute your strategy with efficiency and precision while keeping your team lean and your resources protected.

track progress

Monitor and measure progress on the value creation strategy in real-time across the portfolio, enabling earlier intervention and course corrections when needed.

demonstrate impact

Evidence your ability to deploy capital and drive value across the portfolio, building confidence from discerning LP investors for today and tomorrow’s fundraising efforts.

Powering More Than

Portfolio Companies

Private Equity Sponsors

Value Creation Initiatives

See the Difference

Plan & Align

Inconsistent value creation planning and absence of true alignment and collaboration between sponsor and management teams

Strategy

Enhanced alignment and clarity among all teams around strategy, tactics, ownership, and success measures

Execute & Track

Lack of ownership and understanding of desired outcomes among team members with limited ability to gauge status of projects

Value

Track progress of strategic initiatives seamlessly, leading to increased accountability and flawless execution of the value creation plan

Measure & Report

Data manually inputted into Excel spreadsheets, reports and documents shared via email, and presentations recreated for each meeting

Efficiency

Automated data flows powers a single source of truth on KPIs, saving countless hours spent data wrangling and developing unique content

Repeat & Scale

Lack of transparency and documentation around successful strategies and tactics, leading to minimal sharing of best practices

Success

Value creation success stories are captured in a structured manner, enabling repeatability across the portfolio

Hear From

our clients

Argonaut approaches each of its investments as a partnership with the seller, and immediately recognized Maestro’s strengths in helping its portfolio partners grow their companies’ top and bottom lines. Within weeks of launch, the Argonaut operations team had Maestro up and running, using it to craft detailed value creation journeys and to track KPIs tied to investment objectives.

Brian GreenVice President, Argonaut Private EquityMaestro has become an invaluable platform used across our organization to seamlessly organize, measure, and track value creation initiatives across the enterprise.

Andrew CisnerosVP of Strategy, Channel Control Merchants, LLCWith value creation at the core of our approach, we had no choice but to make this software package the heart of our technology roadmap –> PE 2.0

Sander van WoerdenFounding Partner, Lexar PartnersSchedule a Product Briefing

Serving the world’s premier private equity firms and their portfolio companies, with offices in New York City and Boston.

Where to Find Us:

New York City

One Vanderbilt Ave, 24th FloorNew York, NY 10017

Boston

100 Franklin StreetBoston, MA 02110

Eager to Learn More?

Download our brochure to learn more about how you can accelerate value creation at your firm