The State of the PE Sponsor-CFO Relationship: Top Tech Takeaways

METHODOLOGY

The State of the PE Sponsor-CFO Relationship survey was conducted by Accordion, in conjunction with Wakefield Research, among 200 total participants—including 100 private equity (PE) sponsors (senior executives) and 100 chief financial officers (CFOs) at private equity-backed companies with $50 million or more in annual revenue. The CFO and PE sponsor samples were collected in the first quarter of 2019, using an email invitation and an online survey.

The results of any sample are subject to sampling variation. The magnitude of the variation is measurable and is affected by the number of survey respondents and the level of the percentages expressing the results. For the surveys conducted in this particular study, the chances are 95 in 100 that a survey result does not vary, plus or minus, by more than 9.8 percentage points, in either the CFO or PE sponsor sample, from the result that would be obtained if surveys had been conducted with all persons represented by the samples.

INTRODUCTION

Private equity is undergoing a period of profound change as value creation plays an elevated role across firm portfolios.

Accordion undertook a survey of PE sponsors and portfolio company CFOs to understand how shifting industry headwinds have affected the dynamic between PE firm and company management, specifically with the CFO, who sits at the nexus of that relationship.

The State of the PE Sponsor-CFO Relationship found the good, the bad, and the confusing aspects of the firm-finance dynamic. The survey also found an interesting and important sub-plot: the elevation of technology. This elevation reflects the industry’s evolution from private equity to private techquity (PT). If PE is an industry that shies away from operational adoption of technology, PT is a sector that embraces it as the beating heart of efficiency.

Following is a brief overview of the survey’s key private techquity takeaways:

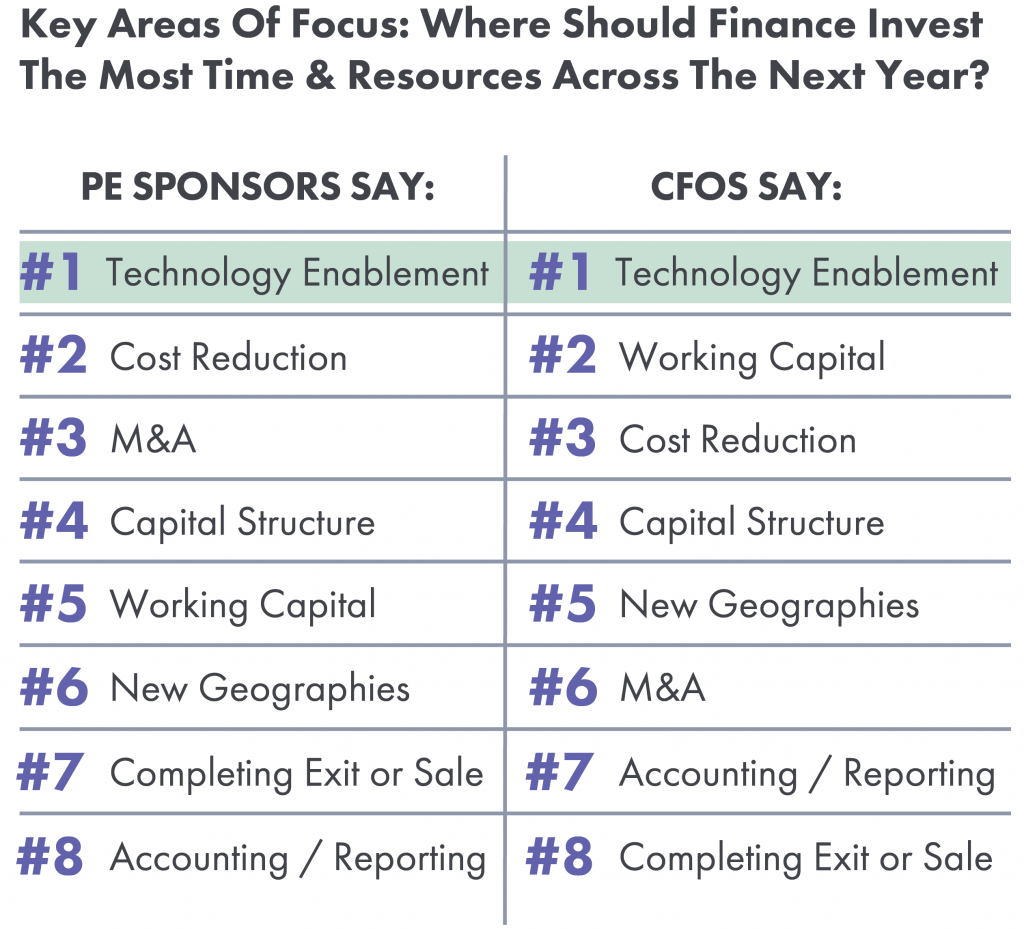

PE GETS ‘WOKE’ TO TECH:

Sponsors and CFOs share the perspective that tech enablement must be a key (if not the key) area of focus for the finance department across the next year.

On the CFO side, technology prioritization is a logical outgrowth of the evolution of that role. As has been well-documented, the days of the controller-style department are long gone. Whether in the form of ERP, CRM, or BI (or more likely, a combination of all three and then some), technology is helping the finance function collect, organize, analyze, and contextualize data. This synthesized data can be used with predictive analytics to enhance forward-looking business decisions and strategy. Tech enablement also automates what had been laborious, manual reporting tasks, freeing up resources to tackle the business advisory functions of the finance role.

On the sponsor side, a new wave of tech-centric PE firms has enlightened the industry to both the short- and long-term benefits of technology. As a result, many firms have actively recruited technologists and tech industry veterans to serve as operating partners. These executives, in turn, have fully embraced the role technology can play to help finance teams find and mine the data at their disposal to inform accelerated decisions and enhanced value creation.

ADDING VALUE TO VALUE CREATION:

On the subject of value creation, sponsors and finance teams are in overwhelming agreement about the role technology should play vis-à-vis those strategies.

Eighty-six percent of CFOs and 88% of sponsors believe having a digital value creation plan would make the relationship between sponsor and CFO more successful and productive.

That CFOs value a digital plan, which would enhance visibility into, and alignment around, sponsor priorities is interesting, but not surprising. That sponsors overwhelmingly agree is both surprising and telling: It suggests that the PE market is eager to professionalize, operationalize, and institutionalize value creation.

RELIEVING REPORTING BURDENS:

The firm-CFO relationship is a delicate one, made more difficult by the fact that most CFOs feel the reporting demands of their sponsor are unreasonable and place an unnecessary burden on the finance team.

CFOs are eager to relieve the burden, and are looking for a solve in the form of digital assistance. Eighty-four percent of CFOs believe enhanced technologies that ease requests for financial reports would help improve the relationship with their private equity team.

Although sponsors do not feel their requests are overly burdensome, 91% still share the CFO view that technology to further minimize the reporting disruptions and distractions would be helpful to the CFO-PE firm dynamic.

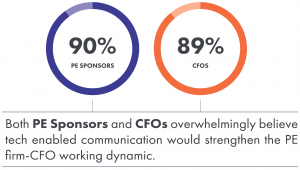

TECH FOR THE WIN:

On the bigger question of the broader CFO-PE firm dynamic, the survey found that an overwhelming majority of CFOs believe that increasing PE firm operational involvement would promote a more successful working relationship.

That collaboration, they believe, can—and should be—supported by better use of technology. Almost 90% of CFOs believe that tech-enabled communication tools would promote a more productive relationship between PE teams and the finance department, a view that sponsors overwhelmingly share.

CONCLUSION

As the survey results make clear, both PE sponsors and PE-backed CFOs are eager for, and receptive to, technology that streamlines firm-CFO communication, automates and enhances the reporting process, and standardizes operational guidance via a digital value creation plan. Critically, both CFOs and sponsors also see technology enablement (via predictive analytics) as a core priority on the CFO’s near-term agenda. Welcome to private techquity…